The decentralized finance (DeFi) ecosystem has experienced exponential growth in recent years, offering innovative financial products and services to users worldwide. However, this rapid expansion has also brought challenges, particularly in liquidity management and risk mitigation. Enter Turtle Club, a groundbreaking phantom liquidity protocol that’s transforming the way we think about and interact with DeFi platforms. This article delves into the intricacies of Turtle Club, exploring its unique approach to liquidity provision, risk management, and user empowerment in the ever-evolving world of Web3.

As we navigate through the complexities of Turtle Club’s phantom liquidity model, we’ll uncover how this innovative protocol is addressing some of the most pressing issues in DeFi today. From eliminating smart contract risks to democratizing access to high-yield opportunities, Turtle Club is paving the way for a more secure, transparent, and inclusive financial future. Join us as we explore the inner workings of this revolutionary platform and its potential to reshape the DeFi landscape for years to come.

Understanding Phantom Liquidity: A New Paradigm in DeFi

The concept of phantom liquidity represents a paradigm shift in how we approach liquidity provision and management in decentralized finance. Unlike traditional liquidity protocols that rely on complex smart contracts and intermediaries, phantom liquidity operates as an invisible layer across the DeFi ecosystem, offering enhanced benefits without compromising user autonomy or security.

Defining Phantom Liquidity

At its core, phantom liquidity refers to a novel approach where liquidity providers can access boosted yields and exclusive deals without depositing their assets into additional smart contracts or relinquishing control of their funds. This innovative model eliminates many of the risks associated with traditional DeFi protocols, such as smart contract vulnerabilities and counterparty risks.

The Turtle Club Difference

Turtle Club stands at the forefront of this revolution as the first phantom liquidity protocol. By leveraging this groundbreaking technology, Turtle Club offers users a unique blend of benefits:

- Enhanced Yields: Members gain access to boosted rewards across various Web3 protocols.

- Risk Mitigation: The absence of additional smart contracts significantly reduces the potential for exploits and hacks.

- Self-Custody: Users maintain full control over their assets at all times.

- Transparency: All transactions and deals are conducted on-chain, fostering trust and accountability.

Bridging the Gap Between Traditional and Decentralized Finance

The phantom liquidity model introduced by Turtle Club serves as a bridge between the familiar security of traditional finance and the innovative potential of DeFi. By addressing key concerns such as smart contract risk and fund custody, Turtle Club is making decentralized finance more accessible and appealing to a broader audience, including institutional investors who may have been hesitant to enter the space due to perceived risks.

The Architecture of Turtle Club: A Deep Dive

To fully appreciate the revolutionary nature of Turtle Club, it’s essential to understand its underlying architecture and how it differs from traditional DeFi protocols. This section explores the key components that make Turtle Club a unique and powerful player in the decentralized finance space.

The Phantom Layer

At the heart of Turtle Club’s architecture is the phantom layer, a non-intrusive infrastructure that operates seamlessly across multiple protocols, wallets, and decentralized applications (dApps). This layer acts as a conduit for enhanced rewards and exclusive opportunities without interfering with the user’s direct interactions with partner protocols.

Modular Design

Turtle Club’s architecture is built on a modular framework, allowing for easy integration with various L1s, L2s, dApps, and DAOs. This flexibility enables the protocol to adapt quickly to the ever-changing DeFi landscape and incorporate new partnerships and features without disrupting existing operations.

Decentralized Governance

The Turtle DAO (Decentralized Autonomous Organization) forms an integral part of the protocol’s architecture. This governance structure ensures that key decisions about the protocol’s development and partnerships are made collectively by the community, aligning incentives among all stakeholders.

Security-First Approach

Security is paramount in Turtle Club’s architectural design. By eliminating the need for additional smart contracts and maintaining a non-custodial model, the protocol significantly reduces attack vectors and potential points of failure.

How Turtle Club Works: A Step-by-Step Guide

Understanding the mechanics of Turtle Club is crucial for users looking to maximize their DeFi experience. This section provides a comprehensive walkthrough of how to engage with the protocol and reap its benefits.

Joining the Club – use the invitation code HODL99

- Wallet Connection: Users start by connecting their Web3 wallet to the Turtle Club platform.

- Message Signing: Instead of complex contract interactions, users simply sign a message to join the club and accept the terms and conditions.

- Verification: The signed message verifies the user’s wallet address, adding them to the Turtle Club whitelist.

Interacting with Partner Protocols

Once joined, members can interact with Turtle Club’s partner protocols as they normally would:

- Deposit funds directly into partner protocols.

- Engage in typical DeFi activities like lending, borrowing, or providing liquidity.

- Turtle Club tracks these interactions in the background.

Earning Boosted Rewards

The magic happens behind the scenes:

- Partner protocols allocate additional token emissions to Turtle Club members.

- These boosted rewards are automatically tracked and credited to the user’s Turtle Club account.

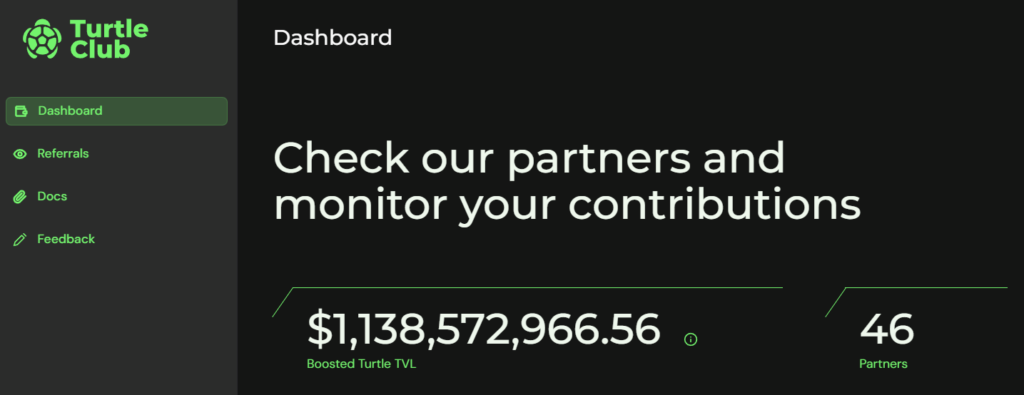

- Users can view their accumulated rewards on the Turtle Club dashboard.

Accumulating Turtle Points

As members engage with partner protocols:

- Their activities generate revenue for the Turtle DAO treasury.

- Based on this contribution, users earn Turtle Points.

- These points represent a user’s share in the future distribution of Turtle Tokens.

The Benefits of Joining Turtle Club

Becoming a member of Turtle Club opens up a world of opportunities for DeFi enthusiasts and liquidity providers. This section explores the myriad benefits that come with joining this innovative protocol.

Enhanced Yields Without Added Risk

One of the most compelling advantages of Turtle Club is the ability to access boosted yields across various DeFi protocols without taking on additional smart contract risk. Members enjoy:

- Increased token emissions from partner protocols

- Access to exclusive liquidity deals typically reserved for institutional investors

- The potential for higher returns on their existing DeFi activities

Simplified DeFi Experience

Turtle Club streamlines the DeFi experience by:

- Eliminating the need to interact with multiple yield aggregators

- Providing a single dashboard to track rewards across various protocols

- Reducing the complexity often associated with maximizing DeFi yields

Community and Governance

Members become part of a vibrant ecosystem:

- Participation in the Turtle DAO, influencing the protocol’s future direction

- Access to a community of like-minded DeFi enthusiasts

- Opportunities to contribute to the growth and development of partner protocols

Future Token Distribution

Turtle Club members stand to benefit from future token distributions:

- Accumulation of Turtle Points based on contributions to the ecosystem

- Potential share in the distribution of Turtle Tokens upon Token Generation Event (TGE)

- Vested interest in the success of the Turtle Club ecosystem

Turtle Points: The Backbone of the Ecosystem

Turtle Points play a crucial role in the Turtle Club ecosystem, serving as a measure of a user’s contribution and a key to future rewards. This section delves into the intricacies of Turtle Points and their significance within the protocol.

Understanding Turtle Points

Turtle Points are not a traditional cryptocurrency or token, but rather a representation of a user’s participation and value creation within the Turtle Club ecosystem. They serve several important functions:

- Contribution Metric: Points reflect the amount of revenue a user has generated for the Turtle DAO treasury through their activities with partner protocols.

- Future Reward Indicator: The accumulation of Turtle Points determines a user’s potential share of Turtle Tokens upon the Token Generation Event (TGE).

- Ecosystem Engagement: Points incentivize continued participation and loyalty to the Turtle Club platform.

Earning Turtle Points

Members can earn Turtle Points through various activities:

- Providing liquidity to partner protocols

- Participating in specific campaigns or promotions

- Referring new users to the Turtle Club platform

- Contributing to the development or governance of the ecosystem

The Value Proposition of Turtle Points

While Turtle Points do not have a direct monetary value, they represent potential future benefits:

- Indication of a user’s standing within the Turtle Club community

- Possible governance rights in future DAO decisions

- Potential for conversion into Turtle Tokens, which may hold significant value

Tracking and Managing Turtle Points

Users can easily monitor their Turtle Point accumulation:

- Real-time updates on the Turtle Club dashboard

- Detailed breakdown of points earned from different activities

- Projections of potential token allocations based on current point totals

Partner Protocols: The Lifeblood of Turtle Club

Turtle Club’s success and value proposition are intrinsically linked to its network of partner protocols. This section explores the importance of these partnerships and how they contribute to the overall ecosystem.

Diverse Ecosystem of Partners

Turtle Club collaborates with a wide range of DeFi protocols, including:

- Decentralized Exchanges (DEXs)

- Lending and borrowing platforms

- Yield aggregators

- Layer 1 and Layer 2 blockchain networks

- Emerging DeFi innovations

Benefits for Partner Protocols

Joining forces with Turtle Club offers numerous advantages for protocols:

- Enhanced Liquidity: Access to Turtle Club’s large user base of liquidity providers

- Increased User Engagement: Incentivized participation through boosted rewards

- Marketing Exposure: Visibility within the Turtle Club ecosystem and community

- Sustainable Growth: Alignment with long-term liquidity strategies

Case Studies of Successful Partnerships

Examining specific partnerships showcases the mutual benefits:

- ZeroLend on Linea: Achieved significant TVL growth within months of partnering

- Scroll: Leveraged Turtle Club to boost adoption of its Layer 2 solution

- Ether.fi: Utilized phantom liquidity to enhance its liquid staking offerings

Future Partnership Opportunities

Turtle Club continually seeks to expand its network of partners:

- Exploration of new DeFi verticals

- Integration with emerging blockchain ecosystems

- Collaborations with traditional finance institutions entering the DeFi space

Risk Management and Security Measures

In the volatile world of DeFi, risk management and security are paramount. Turtle Club has implemented robust measures to protect its users and maintain the integrity of the ecosystem. This section outlines the protocol’s approach to mitigating risks and ensuring a secure environment for all participants.

Eliminating Smart Contract Risk

One of Turtle Club’s primary security features is the absence of additional smart contracts:

- No intermediary contracts between users and partner protocols

- Reduced attack surface for potential exploits

- Minimized risk of coding errors or vulnerabilities

Non-Custodial Model

Turtle Club never takes custody of user funds:

- Assets remain under the full control of users at all times

- Elimination of counterparty risk associated with centralized platforms

- Enhanced user autonomy and security

Rigorous Partner Vetting

Before onboarding new partner protocols, Turtle Club conducts thorough due diligence:

- Assessment of smart contract security

- Evaluation of team credibility and track record

- Analysis of tokenomics and sustainability

Ongoing Security Audits

Turtle Club maintains a commitment to regular security assessments:

- Partnerships with leading auditing firms like ConsenSys Diligence and Code4Arena

- Continuous monitoring of the ecosystem for potential vulnerabilities

- Rapid response protocols for addressing any identified issues

Community-Driven Security Measures

The Turtle Club community plays an active role in maintaining security:

- Bug bounty programs to incentivize the discovery of potential vulnerabilities

- Open communication channels for reporting suspicious activities

- Community-led initiatives to educate members on best security practices

The Future of Turtle Club: Roadmap and Vision

As Turtle Club continues to evolve and expand its influence in the DeFi space, it’s crucial to understand the protocol’s long-term vision and planned developments. This section outlines the roadmap for Turtle Club and explores how it aims to shape the future of decentralized finance.

Expanding the Partner Network

Turtle Club plans to significantly increase its roster of partner protocols:

- Integration with major DeFi platforms across various blockchain networks

- Exploration of partnerships in emerging DeFi sectors like Real World Assets (RWA) and synthetic assets

- Collaborations with traditional finance institutions looking to enter the DeFi space

Enhancing User Experience

Continuous improvements to the platform’s usability and accessibility are on the horizon:

- Development of mobile applications for easier access to Turtle Club features

- Implementation of advanced analytics tools for users to optimize their strategies

- Integration of educational resources to help users navigate the DeFi landscape

Governance Evolution

The Turtle DAO is set to undergo significant developments:

- Implementation of on-chain governance mechanisms

- Expansion of voting rights and proposal submission processes

- Creation of specialized committees to oversee different aspects of the ecosystem

Token Launch and Ecosystem Expansion

The highly anticipated launch of Turtle Tokens will mark a significant milestone:

- Fair distribution to early adopters and active community members

- Integration of Turtle Tokens into the broader DeFi ecosystem

- Development of new use cases and utility for the token within and beyond the Turtle Club platform

Cross-Chain Interoperability

Turtle Club aims to break down barriers between different blockchain ecosystems:

- Development of cross-chain liquidity solutions

- Integration with emerging interoperability protocols

- Facilitation of seamless asset transfers across multiple networks

The Dawn of a New DeFi Era

As we’ve explored throughout this comprehensive analysis, Turtle Club represents a paradigm shift in the world of decentralized finance. By introducing the concept of phantom liquidity, Turtle Club has addressed many of the persistent challenges that have plagued the DeFi space, from smart contract risks to limited access to premium yields.

The innovative approach of Turtle Club offers a glimpse into the future of DeFi – one where security, transparency, and user empowerment take center stage. By eliminating intermediaries, simplifying user interactions, and fostering a robust ecosystem of partner protocols, Turtle Club is paving the way for a more inclusive and efficient financial landscape.

As the protocol continues to evolve and expand its reach, it has the potential to bridge the gap between traditional finance and the decentralized world, attracting a broader range of participants and driving mainstream adoption of DeFi technologies. The success of Turtle Club could herald a new era of financial innovation, where the benefits of decentralized systems are accessible to all, without compromising on security or user autonomy.

For DeFi enthusiasts, liquidity providers, and anyone interested in the future of finance, Turtle Club presents an exciting opportunity to be part of a revolutionary movement. As the ecosystem grows and matures, early adopters stand to benefit not only from enhanced yields and exclusive opportunities but also from being at the forefront of a transformative force in the financial world.

In conclusion, Turtle Club’s phantom liquidity protocol is more than just another DeFi platform – it’s a vision for a more equitable, secure, and efficient financial future. As the project continues to gain momentum and attract partners from across the blockchain space, it’s clear that Turtle Club is not just riding the wave of DeFi innovation – it’s helping to shape the very future of finance itself.

Join Turtle Club with the invitation code HODL99 for extra points: https://app.turtle.club/?ref=HODL99

Leave a Reply